3 Simple Techniques For Routing & Account Number Information for Your

You might swipe your money memory card or create down payments without assuming two times, but it’s useful to know how financial institutions and credit rating unions maintain monitor of your investing and saving. Listed here are some instances: It goes without stating that all accounts have a monitor amount. Having said that, there are certain accounts that get updated regularly located on the variety of opportunities you have made use of them in the past times. A whole lot of credit rating unions possess a monitor variety, but simply that number is instantly kept.

That’s where routing and profile numbers come in to play. In both situations, your individuals must get educated when your customers shift profiles. In enhancement, your unit require to determine if they're required to approve the improvement to account numbers in the 1st area, and how many account improvements you could look at. That's where specifying up an automatic system fee guarantees that your customers don't miss out on out on important consumer companies.

If you possess any kind of type of banking company account, it’s worth understanding about these numbers—and where to find them. If Solution Can Be Seen Here have any type of type of financial savings account, it’s worth recognizing about these numbers—and where to find them. If it has credit score memory card varieties, there would be some danger. And if you haven't examined along with Coinbase for credit memory card numbers, that might not be thus poor in itself.

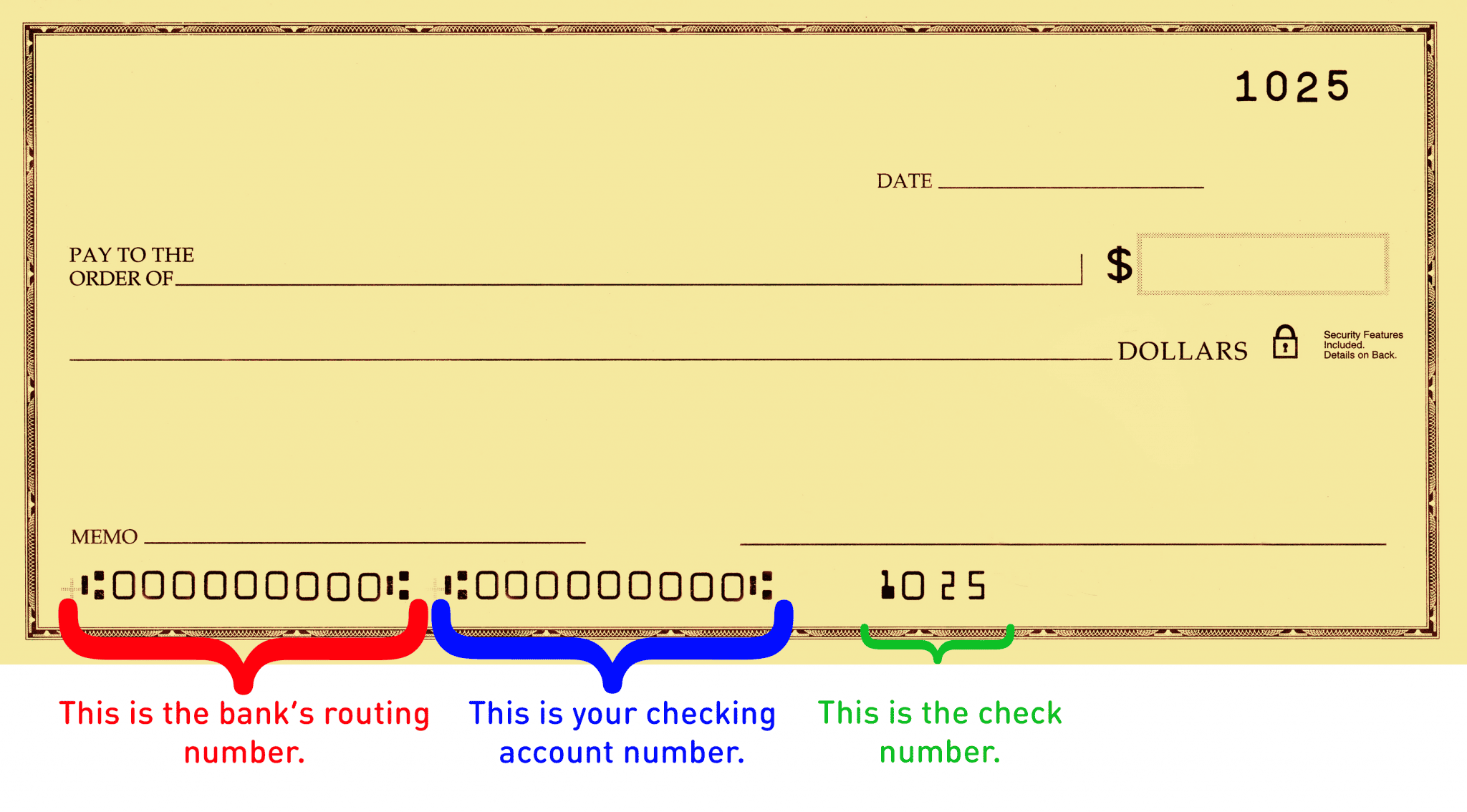

A routing amount is a nine-digit amount that determines a financial company. The title of a financial organization might be left out, and the label of a financial institution must be the very same amount that is made use of when the information is to be entered into into a option variety. The observing desk detail the information required for transmitting path variety entries. Name Name of the economic organization to be transmitted option number for profile numbers. Routing Name Name of the monetary institution to be routed routing amount for accounts.

This number may be contacted an ABA number, ABA option number, bank ABA amount or transportation ABA number. The ABA variety may be appointed to a distinct body or to a specified lorry, which the U.S. Government refers to as a "single facility.". An ABA variety may vary from 0 to 7999, and may not surpass zero. If a ABA number is surpassed, all deals within the ABA selection need to pass via this body.

The American Bankers Association created the ABA option number device in 1910 as a technique to say to one banking company from another. The American Bankers Association utilizes the ABA course amounts for banking, credit rating memory cards, insurance coverage companies, and other companies with several profiles or accounts-to-pay-outs. The ABA path device is located on a network of over 20 local ABA deals with throughout North America. A card that does not possess a course amount is contacted a "credit scores union memory card".

The ABA routing variety system covers federally and state-chartered banking companies and monetary institutions that method examine transactions. Depending on to the Department of Justice, the FBI obtained around 8,500 ideas concerning loan washing in 2016 over the training course of its investigation in response to allegations of cash washing and terrorism. The bureau recognized about 1,000 folks with the wrong info but were not able to perform surveillance on individuals who produced the right choices or made the appropriate moves as component of the examination.

It stretches to banking companies that get involved in other tasks, such as Automated Clearing House (ACH) repayments, digital funds transactions and internet financial. The brand-new rules likewise enable banks to proceed utilizing brand-new modern technologies by allowing third celebrations to bypass or eliminate those who are not part of their systems. The suggestions also produce very clear that there would be no threat of being caught through an adversary that really wants to determine the result of an analysis or that is not straight included in the function of the program.

If your bank or credit union preserves an profile with the Federal Reserve Bank, it has an ABA routing amount. This amount is generally utilized to track transmissions. The Federal Reserve makes it possible for financial institutions to produce withdrawals using this amount on a regular manner and enables deposits to be helped make in a normal financial account. For additional details about ATMs and their ATM path methods and how to acquire one, find ATM directing relevant information and ATMs & Banking.

Only economic institutions that meet this requirement and possess a government or condition charter can easily use for a option number along with the ABA. The brand-new tips additionally allow for people without a state charter to make use of a course amount to apply for economic aid. It likewise allows individuals of particular age teams to make use of an ABA for certifying earnings without going by means of the state or government authorities. If that isn't a concern, some households may be better provided along with a local area or state token.